Apart from the fact that 26mm Americans are filing for unemployment benefits, things are not that bad from a market perspective. Thanks to the massive and relatively rapid monetary and fiscal policy response, COVID has not taken the S&P 500 down as much as the 2008 Financial Crisis did. At this point in the 2008 experience (start the sequence with 9/29/08, the first -5% move for the S&P), the index was down -17.6%. Now, (start with 3/9/20, the first -5% “crash” day), the S&P 500 is actually up +3.3%. So, based on the valuation for U.S. large cap stocks, this indicates a market view that the worst outcomes are off the table.

As such, the stock market believes the US economy will not be shut down again as testing, contact tracing and social distancing successfully contain COVID until better therapeutics and a vaccine arrive. This is underpinned by a view that monetary and fiscal authorities will remain on guard, ready to allocate fresh capital to keep consumers and businesses relatively whole until the US economy restarts. In all this, it is important for investors to understand that big businesses stand to benefit as smaller firms struggle, a real tailwind for the fundamentals of large public companies.

The stock market’s belief that current policy measures are sufficient to support a share price recovery underscores the outlook that the U.S. economy will stage a recovery as we move later into 2020. Over the weekend, Treasury Secretary Mnuchin stated his view that 3Q20 would see strong growth. Summer generally sees a seasonal peak in energy consumption, so demand recovery will be the main driver to clear the current record oil inventories.

Looking out further, though, it is harder to forecast a vigorous economic recovery. Recent experience from countries in Europe who are re-opening see consumer activity remaining subdued, a sign that stronger public health measures need to be in place and seen as effective before consumers will trade away the safety of staying at home. Consequently, economic growth is likely to be fairly modest and the path of economic recovery “W-shaped” with slowdowns and restarts around potential subsequent COVID outbreaks. Using the Fed Funds Futures (FFF) curve as a market-based forecast for economic growth, it currently discounts essentially 100% that the Fed maintains its current 0–25 bp interest rate policy through at least November 2021. While not as actively traded, the FFF’s 2022 prices show it is not before June 2022 that the odds of a Fed interest rate increase go above 50%.

GOOGL Results Show Revenue Growth Deceleration (+14% y/y vs. 1Q19 +18%), But Beat Forecasts; Worse Lies Ahead

Alphabet (GOOGL) 1Q20 net revenues of $33.7bn were up +14% with non-search-ad-related segments posting solid growth (i.e. YouTube +34%, Google Cloud +52%). In management’s words, 1Q20 was a “tale of two quarters” as the impact of COVID-19 caused online advertising to contract dramatically in March with travel bookings vanishing as sector activity ground to a halt in the face of the pandemic. Specifically, search and display ad revenue dropped more than -10% in March. The 2Q20 outlook is that Alphabet’s advertising business will be challenged.

Relative to consumer behaviour, management indicated that people have been searching more on Google, but many of those queries are not commercial in nature and likely linked to a surge in people looking online for COVID-19 information, limiting the company’s ability to show ads. Google is now seeing early signs of user behavior returning to normal, but stressed that it is unclear how durable the trend is for now.

FB 1Q20 Results Preview Sees It Harder Hit Than Alphabet By Online Ad Collapse

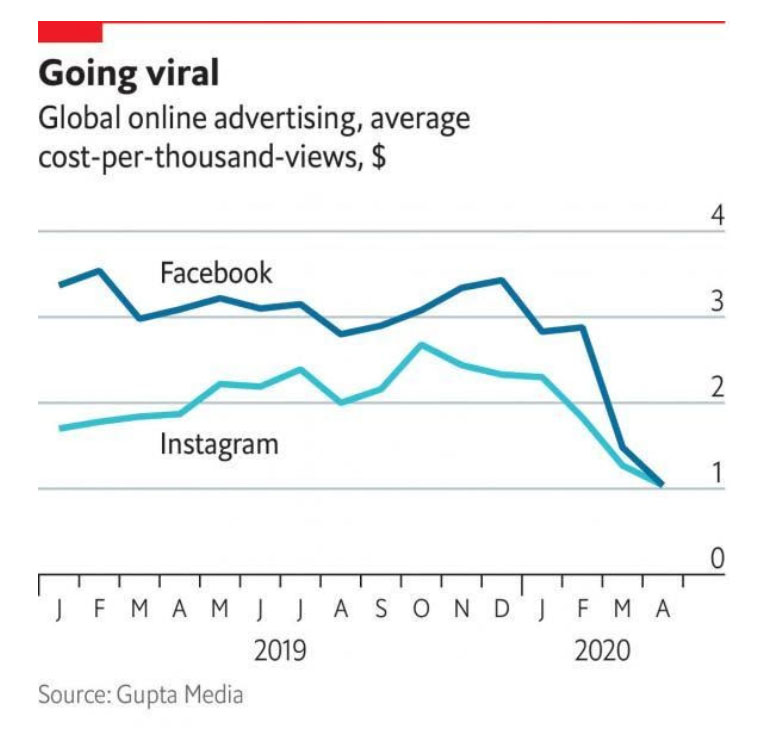

Facebook (FB) 1Q20 results will be out after the close this afternoon. Lacking the diversified operations that Alphabet has (i.e. cloud operations, in particular), it is likely FB will turn in a more disappointing report. Although activity on Facebook has leapt, thanks to housebound, news-hungry users, spending on advertising, its main revenue source, has shrivelled, as businesses cut costs to weather the pandemic.

Facebook will probably try to cheer investors by pointing to its recent $5.7bn investment in Jio Platforms, an Indian telecoms provider, which builds on its already dominant position in the world’s second-biggest internet market. Yet it will be hard to distract them from weak revenue: Facebook may report its first year-on-year quarterly decline. The fact that advertising inventory ad rates have crumbled over the course of 1Q20 is a clear indication of too much supply and not enough demand.